Shedding Light on Changing Consumer Behaviour with Economic Data

Consumer behaviour is changing due to COVID-19. We explore the underlying economic drivers that induce this change in consumer behaviour.

The COVID-19 pandemic has fundamentally changed the world compared to how we knew it in the late 2019. Irrespective of the country we live or work in, the way globalisation makes us interdependent of each other makes us all affected by the consequences of the crisis. The widespread measures introduced by governments to contain COVID-19 pandemic led to temporary shutdowns in businesses, disruptions in the international supply chains, and restrictions in mobility. Furthermore, the measures have disrupted the way people work, learn, socialise and consume, inducing a transformation of societal behaviour and resulting in a substantial change in society, faster and bigger in magnitude than could be observed previously.

Uncertainty exists over the expected dates for restrictions to be eased and the timeline for vaccine development is unknown. Consequently, it is unclear to consumers when all ‘normal’ activities will be resumed. As consumers need to compensate for this uncertainty, they change their behaviour to maximise the stability of their life situation and be prepared for the unpredictable future.

As most of us live in an environment where a tremendous impact of COVID-19 on our daily lives and the economy is visible, it is not surprising that our consumer behaviour has changed. However, it is interesting to explore what the underlying economic thought is on why consumer behaviour changes, and what role drivers such as consumer confidence play in these changes.

Therefore, in this economic data story, we aim to highlight how consumer behaviour during COVID-19 is influenced by economic drivers, by leveraging various datasets. Towards this purpose, we will first discuss how COVID-19 has impacted the world on a macroeconomic level and subsequently explore data on economic drivers that helps us understand changing consumer behaviour within Europe.

Impact of COVID-19 on the worldwide economy

To measure the size of the impact COVID-19 has on a macroeconomic level worldwide, economists draw on macroeconomic indicators. We often hear in the news about the occurrence of an economic recession, rising unemployment figures, or that mortgage bonds are collapsing. These are collectively known as macroeconomic indicators. They provide insights into the current state of the economy and help predict future trends that can display whether the economy is expanding or contracting.

Figure 1. Collage of news headlines indicating the economic impact of COVID-19

Government agencies are commonly responsible for researching and publishing macroeconomic indicators and release these on a monthly or quarterly basis. When analysing these indicators against their historical trends, one can perform an accurate and effective comparison of how the economy changed. Leveraging this data is valuable, as governments can utilise it to develop fiscal policies, central banks draw on it to set monetary policies, and companies, investors, and consumers employ it to make better investment decisions.

Among these macroeconomic indicators are employment figures, inflation, home building or sales, consumer spending and retail sales. Of these indicators, a well-known macroeconomic indicator is real Gross Domestic Product (GDP), which reflects the monetary value of all finished goods and services produced within a country or region during a specific period, adjusted for inflation. Real GDP growth trends are commonly used to indicate how well the economy is doing.

To illustrate the effect of COVID-19 on the economy, real GDP growth trends for both the EU and worldwide are visible in figure 2.

Figure 2: Real GDP growth trends (annual percentage change) for EU and the world, provided by the International Monetary Fund World Economic Outlook.

Figure 2 highlights an unprecedented contraction in real GDP growth in 2020, both in the EU and worldwide. In both cases the drop in real GDP growth is greater than it was when GDP growth was at its lowest point after the credit crisis in 2007-2008. The credit crisis occurred as a result of subprime mortgage lending crises in the US and expanded into a global banking crisis, after which the economy fell into recession. At its lowest point after the credit crisis, in 2009, the GDP growth rate in the EU was -4,2% versus a GDP growth rate of -7,1% in 2020. Worldwide, the GDP growth rate was -0,1% in 2009 versus -3% in 2020. The size of these negative growth rates for 2020 reflects the severe impact of COVID-19 on the economy.

Breakdown of how COVID-19 reduces GDP

Even though GDP is a regularly used macroeconomic indicator, it may be unclear how COVID-19 affects GDP and its growth rate. To elaborate on this causality, we decompose nominal GDP into its parts (see formula 1 below). The difference between real GDP and nominal GDP is that real GDP is obtained when adjusting nominal GDP for inflation. Nominal GDP clearly illustrates how consumer consumption correlates with the other components without adjustments for inflation.

Formula 1: Nominal GDP = Consumer Consumption + Investments (Business) + Government Spending + Net Exports

Nominal GDP consists of four components that can work in opposition to each other to lower or rise nominal GDP. During COVID-19, consumer consumption is drastically decreasing, due to the shut-down of hospitality, entertainment and retail stores, as well as citizens not being able to travel for work or go on holidays due to limitations to circulation. Furthermore, the business investment component decreases, as companies are more careful in spending to ensure stability for upcoming rainy days. Net exports also decrease, as the level of imports and exports are reduced in most countries owing to the supply chain disruption caused due to lockdowns across the world.

On the other hand, government spending increases nominal GDP, as governments intervene with policies that support businesses and consumers with additional funds aimed at reducing the negative economic impact of COVID-19.

Ultimately, looking at the impact of COVID-19 on all four components, real GDP growth during COVID-19 shows a steep drop. As consumer consumption constitutes about two-thirds of all economic activity in most countries, consumer spending is an important factor for determining their economic status. Therefore, we explore what economic drivers induce a change in consumer behaviour.

Consumer behaviour

Consumer behaviour is a field of study that focuses on analysing and understanding the motives and patterns regarding the decisions behind consumers’ purchases and has been a major area of interest for many scientific fields such as economics, marketing, psychology etc. for decades. Consumers’ thoughts and feelings drive their purchasing decisions and are influenced by various personal, psychological, and social factors.

The global health, economic and social crisis caused by COVID-19 is upending people’s lives in all countries. In order to adapt, people are forming new habits, new ways of thinking and contemplate what they value in order to adapt to the current extreme circumstances that intrinsically reflect on their behaviour as consumers. These profound adaptations in consumer behaviour are not only shaping the current economy but some of them are also expected to become permanent after the pandemic creates a new economic reality.

The current uncertainty caused by COVID-19 concerns consumers and results in alterations to how much they would like to spend, how they spend it and what kind of products they purchase. Multiple economic drivers play a role in this changing consumer behaviour, such as consumer confidence, price levels, inflation and income. Below we will first assess the influence of consumer confidence on consumer behaviour. Subsequently, we will briefly address how a change in consumer behaviour can impactprice levels.

Influence of consumer confidence on consumer behaviours

Consumer confidence illustrates how consumers perceive their financial prospects and the overall state of the economy. A higher confidence level indicates that consumers are willing to spend more, while a low confidence level echoes uncertainty about the future and unwillingness to spend. Consequently, consumer confidence will be reflected in saving and spending activities.

Harmonised business and consumer confidence surveys are regularly conducted by the Directorate General for Economic and Financial Affairs for economies in the EU and applicant countries. Questions in these surveys refer to economic developments in recent months and at present, as well as what developments are expected in the next months.

The European Data Portal visualises data from these consumer confidence surveys to determine how consumer confidence is impacted during COVID-19 in multiple areas, including economic confidence, unemployment expectations, savings at present and purchases.

Economy

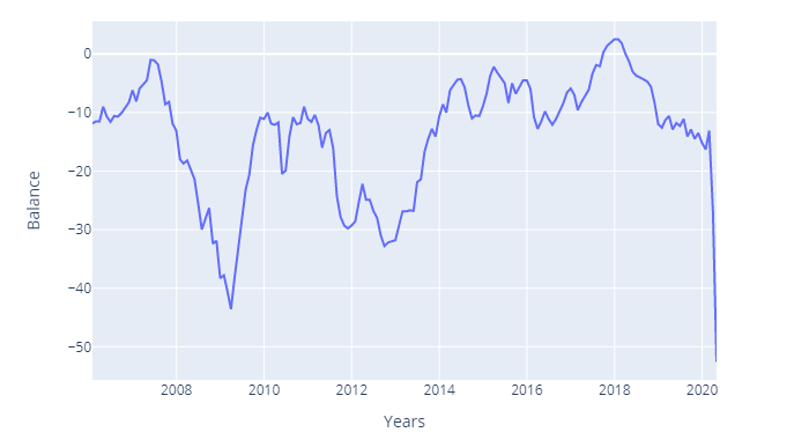

One aspect of consumer confidence is how confident consumers based on the economic situation. In the harmonised surveys, consumers were asked whether they expected the general economic situation in their country to become better or worse over the next 12 months. Trends in EU consumer responses are illustrated in figure 3.

Figure 3: EU consumer confidence on the general economic situation over the next 12 months.

The balance is an economic measure. It is obtained via a calculation that considers the difference between positive and negative answering options in the consumer surveys and is measured as percentage points of total answers. The balance is seasonally adjusted.

In figure 3 a strong dip in consumer confidence on the economic situation over the next 12 months is visible. The trend in economic confidence was already decreasing from a “balance” of 2,5 in 2018 to -16,3 in January 2020. However, during February, March and April 2020 economic confidence drastically went downhill, quickly dipping towards -52,6 by April. Economic confidence is even lower now than it was at its worst point after the 2008 financial crisis, with a value of -43,6 in March 2009. The sharp deterioration in 2020 highlights the insecurity and uncertainty that EU consumers have with regards to the general economic situation.

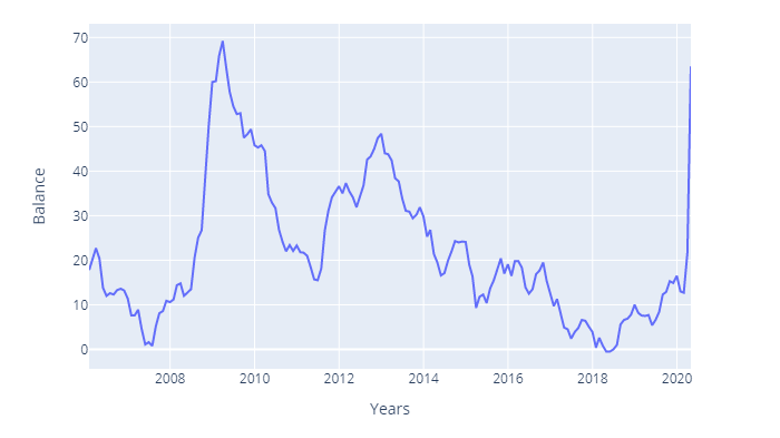

Unemployment

In the harmonised surveys, consumers were also asked how they expected the number of people unemployed in their country to change over the next 12 months. The effect of COVID-19 on EU consumer confidence on unemployment for the next 12 months is visible in figure 4. The figure illustrates that unemployment expectations increased from a balance of 12,7 in February 2020 to 63,5 in April 2020, highlighting the strong effect EU consumers expect COVID-19 to have on unemployment.

Figure 4: EU consumer confidence in terms of unemployment expectations over the next 12 months.

The balance is an economic measure. It is obtained via a calculation that considers the difference between positive and negative answering options in the consumer surveys and is measured as percentage points of total answers. The balance is seasonally adjusted.

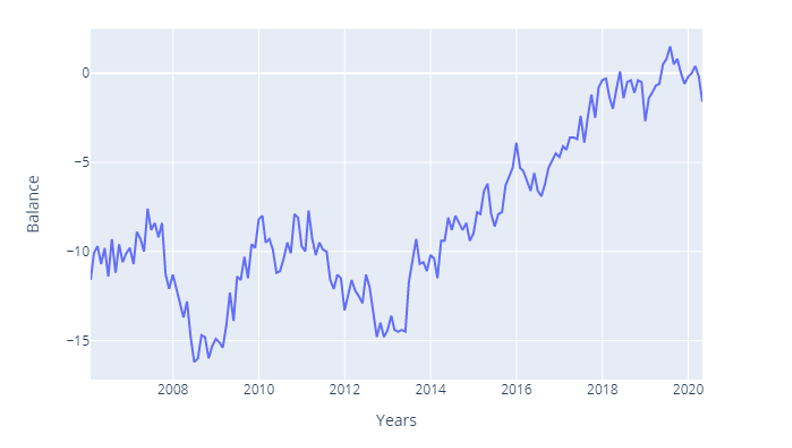

Savings

Another measure from the surveys is how important consumers consider saving money in the next 12 months, which reflects their confidence in terms of their personal financial stability. For this measure, consumers were asked how likely they were to save any money over the next 12 months. In figure 5 we visualise the responses of consumers for the EU. This trend illustrates that consumers are increasing their savings, to account for the uncertainty in income or reduced spending opportunities during COVID-19. As the number of unemployed people increases, the importance of savings will be greater among consumers. The consequence of increased savings is a reduction in spending, and this causes a decline in the economic output.

Figure 5: EU consumer confidence on savings for the next 12 months.

The balance is an economic measure. It is obtained via a calculation that considers the difference between positive and negative answering options in the consumer surveys and is measured as percentage points of total answers. The balance is seasonally adjusted.

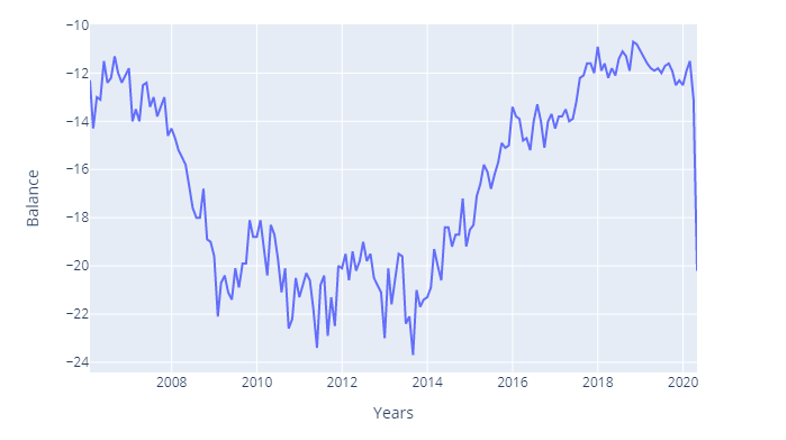

Purchases

Furthermore, economic conditions and personal factors strongly influence consumers in making large purchases. Logically, during a period of economic uncertainty consumers tend to avoid large purchases and their risk appetite is drastically reduced. In the surveys consumers were asked whether, in view of the general economic situation, they thought that it was the right moment for people to make major purchases such as furniture and electrical/electronic devices. As illustrated in figure 6 by the dip in the balance from -11,9 in January 2020 to -20,2 in April 2020, consumers were less confident that it was wise to make large purchases.

Figure 6: EU consumer confidence on making major purchases over the next 12 months.

The balance is an economic measure. It is obtained via a calculation that considers the difference between positive and negative answering options in the consumer surveys and is measured as percentage points of total answers. The balance is seasonally adjusted.

Dynamics between prices and consumer behaviour

As consumer spending plays a large role in our world economy, changes in consumer behaviour and reduced spending can severely affect industries. In this section, we explore how a reduction in consumer spending is correlated to decreases in price levels. It has to be noted, however, that, on the other hand, the relation between price levels and consumer behaviours is reciprocal, and price levels can also affect consumer behaviour in the first place.

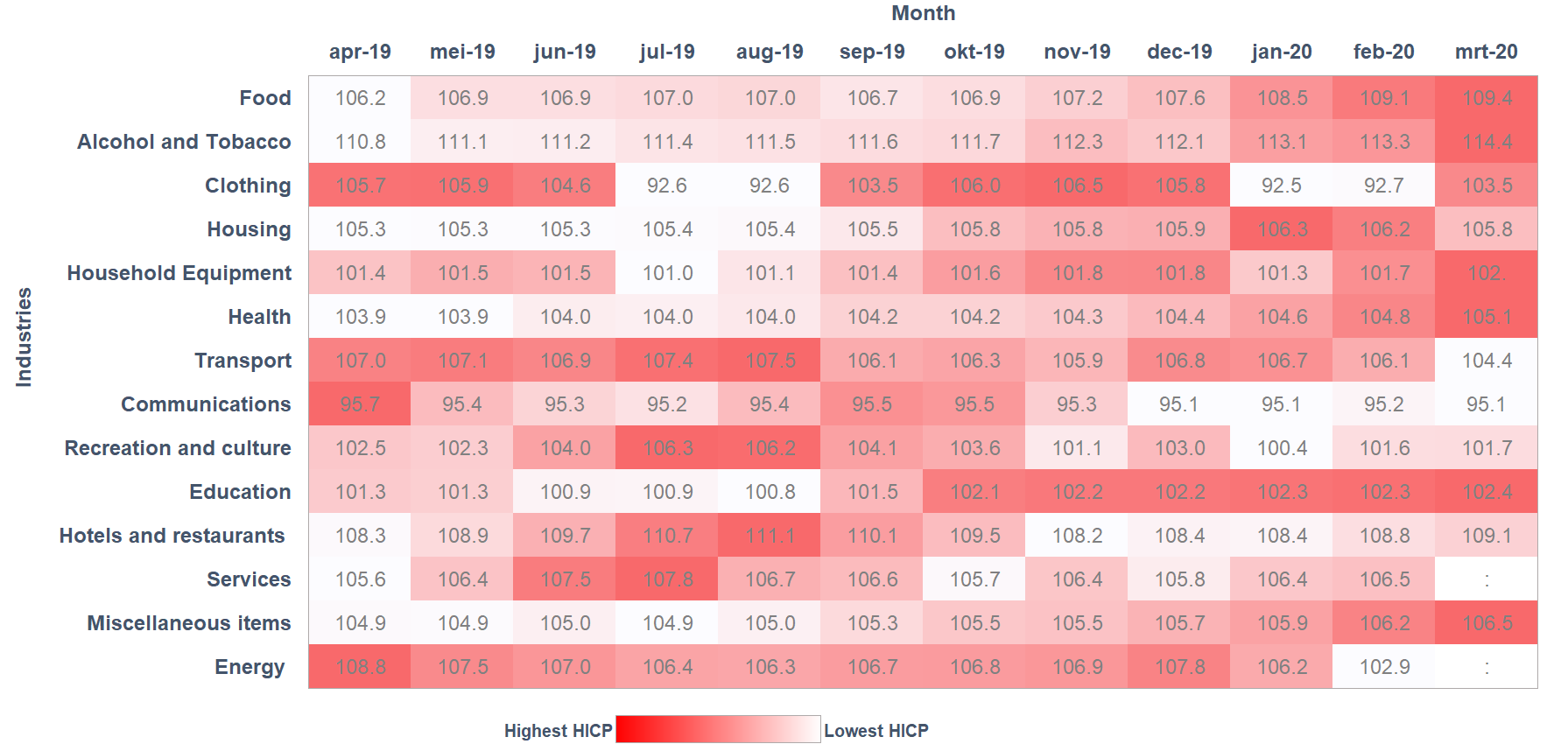

With the shock of COVID-19 on the economy, prices of goods and services are fluctuating, because of the shifts in how consumers spend their money. Eurostat offered a dataset on Harmonised Indices of Consumer Prices, for which the European Data Portal created a heatmap to illustrate how prices of goods and services are changing across different industries.

Figure 7: Harmonised Indices of Consumer Prices (HICP) for the European Union, across different industries.

Harmonised Indices of Consumer Prices (HICP) is an economic indicator of the consumer prices for a basket of goods and services acquired, used or paid for by the households in each EU Member State. HICP data is produced and published using the common index reference period from 2015 which equals to 100.

In figure 7, HICP data from different industries is used to illustrate how the prices per industry were changing over the past year. Moreover, the heatmap amplifies how COVID-19 caused significant price increases in certain industries, illustrated with a darker shade.

Since the effects of COVID-19 started to become tangible for EU citizens in January 2020, stability of food prices was disrupted and a significant price increase in the months of January, February and March was observed. This price increase is associated with the announcement of lockdown measures, followed by panic buying, as well as disruptions in the food supply chains.

A remarkable increase in health costs is also reflected on the HICP figures, highlighting the burden of COVID-19 on healthcare systems and the economy. Furthermore, the restrictions and discouragements of travel on both international and national levels has hit consumer demand the hardest. Therefore, a decline in the prices of e.g. recreation and hotels and restaurants can be observed.

As explained in figure 6, consumers do not feel confident in making major purchases in the next 12 months. Therefore, ever increasing housing prices in the past year, started declining with COVID-19, damaging the housing market.

These findings show that a shock to the markets such as the one caused by COVID-19 can immediately impact prices, due to the significant changes consumers make in their product demand.

Conclusion

As illustrated by the data and visualisations, consumer confidence is an important influencer of consumer behaviour. Due to COVID-19, consumers feel that it is important to keep an increased amount of savings and find it safer to avoid major purchases. This decrease in consumer spending is driven by EU consumers feeling less confident about the general economy and employment in general.

Furthermore, it is interesting that consumer behaviour rapidly affects industry prices, where increased demand made products in certain industries more expensive and products in other industries have become cheaper due to a lower demand.

It is important to be aware that changing consumer behaviour also implies that consumers’ product preferences will be different from what they used to be. This shift in consumer preferences is currently visible in terms of increased online video streaming, online shopping, and favouring activities that work well in the ‘new’ socially distant society.

The question is whether companies are quick enough to reinvent themselves and change their value propositions, to ensure sustainability and profitability by responding to the new consumer preferences as swiftly as possible.

Contact form: https://www.europeandataportal.eu/en/feedback/form

Looking for more open COVID-19 related datasets or initiatives? Visit the EDP for COVID-19 curated lists and follow us on Twitter, Facebook or LinkedIn.